LTA gives S$15,450,617 COE hongbao bonanza to rich elite thi

-

LTA gives S$15,450,617 COE hongbao bonanza to rich elite this CNY.

If this amount squandered on the rich were to be multiplied by 24 COE bidding exercises per annum, I estimate that the PAP gahmen would have easily 'squandered' S$370,814,808 p.a. in all. Instead of spending 2 precious hours squabbling over 1 petty NCMP seat, ought not parliament discuss how the catB COE pricing system should be tweaked so that gahmen revenue will not be spilled/ lost?

Cat B (big cars COE) should ALWAYS be higher than small cars (Cat A), maybe at least 10% more for the tax to be more progressive. Unfortunately, for the the first tender of 2016, big car COE was only $38,610 which is [$46,651- 38,610]= S$8,041 cheaper than small car COEs. Multiply by the number of large car COEs sold (quota=1,216), the estimate loss to Singapore gahmen coffers would be 8041*1216= $9,777,856.

If a rule that large cars COE would ALWAYS be at least 10% expensive more than small cars COEs, then [$4,665.10*1216] should be added= $5,672,761.60.

Total loss to gahmen coffers (with cat B is always 10% pricier than catB rule)= [ $9,777,856+5,672,761]= S$15,450,617.

The reason why wealth inequality in Singapore is so rampant and uncontrolled is because there are probably many elitist within the ranks of PAP gahmen, for example: Wee Shu Min elitism controversy

Wee Shu Min elitism controversy

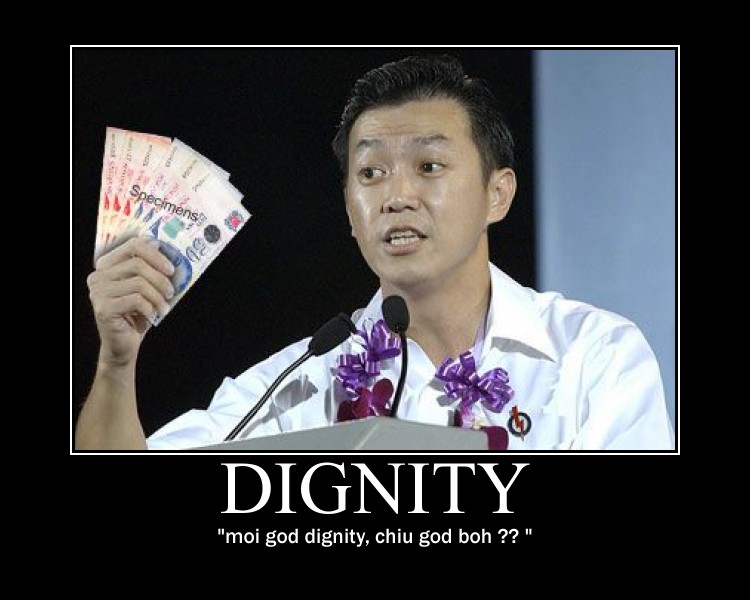

These elitist MPs love to rub shoulders and scratch the backs of CEOs and other rich people whom they seek the attention of in society ('rich friends'). In Singapore, the dignity of the rich to travel in luxury limousines is paramount, I wounder if the palm of the following PAP MP was greased to say what he did:

Providing very affordably priced COEs for LUXURY LIMOUSINES is a very important INFRASTRUCTURE/ SOCIAL SAFETY NET initiative by the PAP gahmen, thus the need to raise GST (to cover for the possible S$370,814,808 in discounts for large car COE p.a.)...:Quote:"If the annual salary of the Minister of Information, Communication and Arts is only $500,000, it may pose some problems when he discuss policies with media CEOs who earn millions of dollars because they need not listen to the minister's ideas and proposals. Hence, a reasonable payout will help to maintain a bit of dignity."

- MP Lim Wee Kiak apologises for comments on pay [IMG URL]

[IMG URL]

Which of course brings us to the question if we are actually electing the wrong priest and worshiping the wrong gods:

Quote:'Without some assurance of a good chance of winning at least their first election, many able and successful young Singaporeans may not risk their careers to join politics,'Mr Goh Chok Tong, June 2006 ['GRCs make it easier to find top talent: SM'].  [Pict=Disassembling GRC system benefits PAP (Part 1 of 3)]

[Pict=Disassembling GRC system benefits PAP (Part 1 of 3)]

PS: the estimated loss of revenue to gahmen coffers would be further increased had I used a more reasonable 33.3% premium of catB COEs above catA COEs given that in excess of 90% of Singaporeans are supposed to be 'poor' and need to stay in HDB gahmen housing, leaving the rich to be an elite minority and thus ought to be the case that catB COEs should be at least 33.3% pricer than the catA ones.__________________ -

then why you dun say that CAT A is way overprice and should be price at S$33 000 instead?

why dun you go HDB carpark and see how many CAT B cars are parked over night everyday? even live in HDB, they are not poor...